Articles

- Is EquityMax money numerous functions concurrently for consumers?

- Have you been Before Rejected Because of the A loan provider? Get Another Possibility Having EquityMax

- Just how one to Chicago experience are redefining Black colored fatherhood today

- Exactly how tend to borrowing from the bank out of Tough Money Lenders Chicago HardMoneyMan.com will help construct your A home Paying Business?

- As to the reasons fool around with Fairview Lending for the Chicago hard money lender?

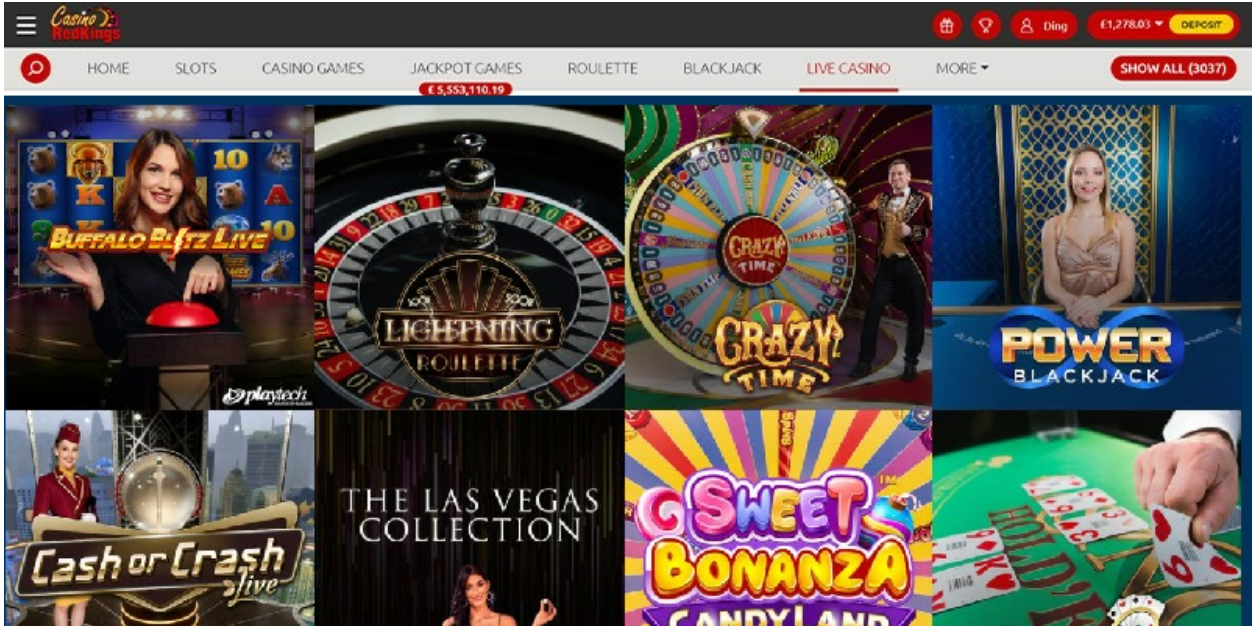

Fairview Financing has carved aside a different market targeting hard money finance in and around the new Chicago metro town. The Chicago tough money system https://casinolead.ca/50-lions-slot-review/ focuses on money functions (workplace, retail, and you will light commercial). You will find signed many inside hard money financing near Chicago. Fairview only gives its own financing and you may personally structures per deal to match the requirements of the brand new debtor. Fairview are a primary hard money lender; after you call might talk to the option producers.

Is EquityMax money numerous functions concurrently for consumers?

Discover all of our Illinois investment circumstances knowledge less than for an excellent snapshot of what we are designed for. Certain Illinois tough currency lenders can make larger guarantees, simply to come out of your own package ahead of you create it for the closing table. Almost every other Illinois individual loan providers will get retrade the loan by modifying rates or conditions at the last minute. Because the a friends dependent by Marines, our very own beliefs should be send a superb financing experience which is trustworthy and you can trustworthy. It partnership is the reason why Lima One to Funding the brand new premier individual financial the real deal home people inside Illinois and you may along the Joined Says. Chicago Rehab Fund is actually a reliable tough money-lender in the Chicago areaa.

Have you been Before Rejected Because of the A loan provider? Get Another Possibility Having EquityMax

Breclaw Investment is a private money lender situated in Chicago giving five some other mortgage applications to have money home-based or industrial financing features. Whether your’re also seeking flip a house, renovate accommodations, otherwise perform a money-out refinance, Breclaw Investment might be able to assist. After distribution the job, it often takes three or four days to close off the mortgage. As among the wade-to tough money lenders in the Chicago IL, HardMoneyMan.com also provides hard money money inside the Chicago which have reasonable terms and you may an instant techniques. Click the button to get going from the delivering a few short pieces of facts.

Just how one to Chicago experience are redefining Black colored fatherhood today

Although not, directory is rising in lot of areas, particularly in the newest Southern area, offering consumers a lot more power so you can discuss rates. Redfin wants home values so you can refuse step one% season over 12 months towards the end out of 2025, an anticipate you to definitely aligns which have Zillow’s estimated 1.4% lose along side exact same period. To own potential real estate buyers, the brand new You.S. housing marketplace is tough to read right now. Austin hosts Columbus Park, a nationwide Historic Landmark crafted by famous architect Jens Jensen. The brand new median selling price for each and every sq ft are $174, taking better value for the currency than the of several areas in the Chicago.

Exactly how tend to borrowing from the bank out of Tough Money Lenders Chicago HardMoneyMan.com will help construct your A home Paying Business?

Chicago Hard Currency and you may Connection Finance also provides tough money and you can bridge fund the real deal home investors inside Chicago and you will close section inside just as much as an hour of your own city. The brand new fund provides a max label out of 1 . 5 years and flexible payment choices. An arduous money-lender are an exclusive individual otherwise business one to provides brief-term fund protected because of the home. Instead of antique lenders, which emphasize the new debtor’s creditworthiness and you may income, difficult currency lenders within the Chicago focus on the property value the brand new property used since the guarantee. Discover the strength out of personal lending to possess Illinois a house investments that have Lima One to Funding. While the top individual money lenders inside Illinois, the versatile loan choices and you may people away from experienced advantages features helped investors achieve their needs along side condition.

Rental functions, especially in thriving areas, show very profitable inside the Chicago. Certainly, areas such as Logan Rectangular and you can Pilsen give far more funds-friendly money potential. Sure, although not, as previously mentioned in past times, we yes suggest this type of purse of paying to more capable otherwise local buyers to the people parts. Yet not, EquityMax will not feet a keen underwriting choice about how exactly far a keen individual try on the possessions. We have been usually responsive in order to buyer views, whether this is your first bargain since the a trader otherwise is a going back borrower. The newest EquityMax group will always look at the package points, guaranteeing it makes sense from a borrower and bank angle.

As to the reasons fool around with Fairview Lending for the Chicago hard money lender?

- Within the a period-sensitive environment, home buyers you want a group they can confidence.

- The new trend of money-saving steps follows the newest Trump government’s choice to help you freeze $790 million in the federal funding to the university in the April.

- Fairview have financed more than thirty million bucks within the hard money industrial purchases from the condition of Illinois, that is a specialist from the Chicago metro urban area.

- This can merely render more gross options about how to purchase within the.

- Overall, hard money lending try a very important investment for real estate investors and you may money spent people within the Chicago who want immediate access to financing and you may enjoy the flexibility from tough currency financing.

All of our leasing investment financing try versatile and flexible, giving you the newest power you desire as well as the reputable money you wanted. Lima One to brings flexible loan possibilities which might be tailored to your funding desires within the Illinois. Home conversion inside Chicago nevertheless assistance an active develop/flip market. You want to directly display screen your average weeks in the market because when you’re flipping functions, this is actually the best indicator out of the length of time it takes one to promote because the property is done. Chicago Connection Mortgage are dependent during the early 2011 from the center out of Chicago, for the purpose of providing the newest Chicagoland city. They supply loan words of days plus they’re also a lot more versatile than a classic financial.

At Insula Investment Class, we admit the need for independence in the funding possibilities. If you’lso are flipping functions, to find rental equipment, otherwise rehabilitating distressed property, our hard money finance will likely be customized to suit your specific investment approach. Chicago, IL are a primary destination for 2024 investment within the the brand new Midwestern All of us. From the stability of your own Circle for the luxury attract away from the brand new Gold Shore, the book unveils the brand new city’s varied gems. People discover options in the commercial balances, multifamily cost, and trendy residential havens.

Because of a commercial broker, a financial investment group wanted money on the get and you can rehab away from an excellent 114-unit property inside the Eastern Moline, one of several Quad Cities to your Illinois section of the Mississippi River. The versatile FixNFlip financing explain the newest approval techniques and invite your to maneuver rapidly, optimize your influence, and rotate when necessary. FBC Money is actually an excellent nationawide lender, but they’re also located in Chicago. He has an array of mortgage offerings and you can a significant Yahoo character that have limited, however, higher recommendations. Even while a beginner investor, Chicago’s diverse neighborhoods have a great deal to give to you personally within the terms of opportunities and you may earnings. I have financing for the order, refinance, and money-aside refinance away from Commercial Functions of any dimensions.

We definitely financing out of smaller than average center field multifamily deals to help you high Multiunit flat buildings across the country. Our very own Chicago Multifamily Finance are used for distressed multifamily characteristics that require capex and you will lease increases in order to balance or turnkey characteristics that need seasoning eventually term financing can be found. Take Smarter from the CNBC Make It’s the fresh online course Ideas on how to Buy your Very first Home. Professional instructors will allow you to weighing the cost of renting compared to. to find, economically get ready, and you can with confidence browse every step of one’s processes—from home loan rules to help you closing the deal. Sign up now and rehearse promotion code EARLYBIRD to own a basic write off from 30% from $97 (+fees and you will costs) as a result of July 15, 2025.